TitleBytes News & Happenings

FIRPTA – What’s it all about and why do we care?

By Allan Dick

FIRPTA (the Foreign Investment in Real Property Tax Act of 1980, as amended), seems to have been a hot topic of late. In response to attendee requests, the MLTA Education Committee included FIRPTA presentations in the 2016 MLTA Spring Seminar, and again this past Spring Seminar. So, what exactly is the issue with FIRPTA, and why is that of such concern and interest to us? What’s it all about?

U.S. tax law requires that all persons, foreign or domestic, must pay income tax on the amount of gain realized on the transfer or disposition of U.S. Real Property Interests. For domestic persons, such (capital) gains and corresponding taxes are typically addressed with the filing of the persons’ annual tax returns sent to the IRS.

FIRPTA was enacted to ensure that foreign persons likewise pay those corresponding taxes, by requiring that the buyer withhold and remit to the IRS a certain percentage of the sales price, in anticipation of the taxes, which will be due from the foreign seller for any such transaction. The amount withheld is not the actual tax itself, but is rather payment on account for the taxes that ultimately will be due from the seller when they file their tax return. FIRPTA applies to virtually all transactions, residential and commercial, in which a foreign owner sells an interest in U.S. real property, whether that foreign seller is an individual, co-tenant, partnership, LLC, corporation, or the fiduciary of a foreign trust or estate.

A seller may be exempt from FIRPTA withholding if:

• The seller is a naturalized U.S. citizen (may have dual citizenship)

• The seller is a resident alien (who has been issued a green card by the U.S. government)

• The seller is a U.S. corporation or an LLC (unless a foreign person holds controlling interest)

• The Buyer intends to occupy the property as a principal residence for the next two years, and the sales price is $300,000 or less

• The foreign seller provides a Withholding Certificate issued by the IRS to the settlement agent prior to closing, which reflects that a reduced amount is owed or no amount is owed at all

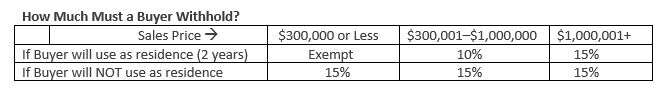

If the property transaction is NOT exempt, the BUYER is obligated to withhold the following percentage of the SALES PRICE (identified as “Amount Realized”, NOT the amount received) and submit that to the IRS within 20 days of closing. Failure to do so may result in a penalty assessed to the Buyer!

Although, it is the BUYER, who has the obligation to withhold the funds and remit them to the IRS, often the parties to the transaction, who are not familiar with the FIRPTA rules and procedures, look to the title company, as settlement agent, to assist with this process. However, as there are exceptions and nuances to the IRS rules, settlement agents are cautioned to not provide tax or legal advice on such matters, instead referring the BUYER to their attorney or tax professional, of the IRS website for any questions, beyond the withholding rules stated above, and the forms set forth here below.

What form does a Buyer (and settlement agent) need from the seller, if the seller claims to be exempt? The buyer needs the seller to sign a FIRPTA Affidavit, attesting that the seller is not a foreign person, and providing additional information (seller’s social security no. or tax identification no. and seller’s address). The Buyer will need to keep that FIRPTA Affidavit as evidence of having complied with the IRS rule, in case the seller is later determined to have been a foreign seller.

If the property is not exempt, what forms are needed, and what is the procedure? Within 20 days of the closing, the funds withheld must be remitted to the IRS, accompanied by IRS forms 8288 and 8288A, COMPLETED AND SIGNED BY THE BUYER. The settlement agent or the buyer’s attorney may choose to assist. But in doing so, that party takes on additional responsibility/liability.

This describes a more common FIRPTA scenario. As you might expect, the IRS rules contain variations and exceptions regarding Withholding Certificates, among other things. For extraordinary circumstances and questions, consult the IRS website or a tax professional.